As the Expert Network industry continues to impact how thousands of business decisions are made each day, our customers’ need for accurate, qualitative research continues to grow.

To understand how Expert Networks are being utilized in the current climate and gain the knowledge necessary to improve our services, Guidepoint has surveyed Expert Network users covering over 50 Consulting and Market Research firms across all geographic regions, with job functions ranging from Junior Consultants to Principals and Partners as well as Research / Knowledge Teams.

Guidepoint’s first Client Survey was completed by more than one hundred users, offering a window into how Expert Networks could better bridge the gap between customer expectations and customer experience.

THE POTENTIAL TO OPTIMIZE THE USAGE OF EXPERT NETWORKS

Our experience (backed up by the survey results) indicates three primary ways that Consultancies can improve their current workflow and obtain the highest service level from Expert Networks:

-

Active management of their Expert Network portfolio

-

Evaluating different Expert Network providers

-

Training Consultants how to get the most from Expert Networks

Actively Managing your Expert Network portfolio

Some of the largest Consultancies will spend tens of millions yearly working with Expert Network firms, translating into more than ten thousand expert interactions per year. This may come as no surprise, especially considering that the Expert Network industry revenues exceeded $1.5 billion in 2020 (Source: The 2020 Expert Network Market Sizing, Integrity Research).

While there are countless opportunities for future growth with Expert Network firms, we cannot help but wonder — to what extent are Consulting Firms managing their ENS portfolio, and how do they allocate their money to influence overall success?

Based on the feedback from our survey respondents, there seems to be a vast discrepancy between the rising importance of Expert Networks in Consulting, the total expenditure allocated on services, and the management of such firms.

Some of the reasons for this scenario can be linked to the exponential growth in Expert Network usage over the last ten years and the fact that Consultancies are traditionally decentralized businesses with lean overhead and limited experience in formalized partnerships with external service providers.

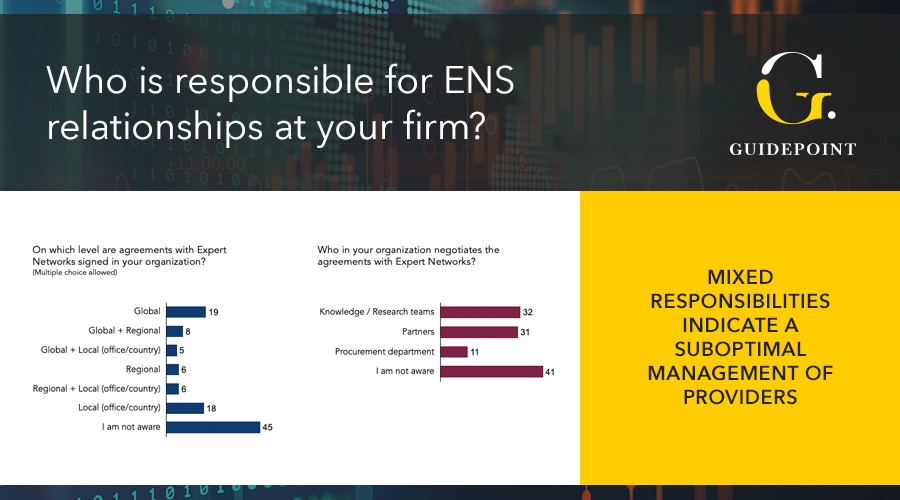

Moreover, the mixture of roles within Consultancies utilizing Expert Network services further reinforces the opportunity for better management of Expert Network providers and services. For instance, our survey reveals that the responsibility for managing relationships with Expert Networks seems to get lost in a triangle of Knowledge / Research teams (32), Partners (31), and Procurement (11) — all “struggling” between local, regional, and global control.

When asked how agreements are signed with Expert Networks at a geographical level in their organization, 42% of respondents mentioned they were not aware. Similarly, 36% of respondents didn’t know who in their firms were responsible for negotiating contracts. In this case, the lack of internal awareness becomes even more apparent.

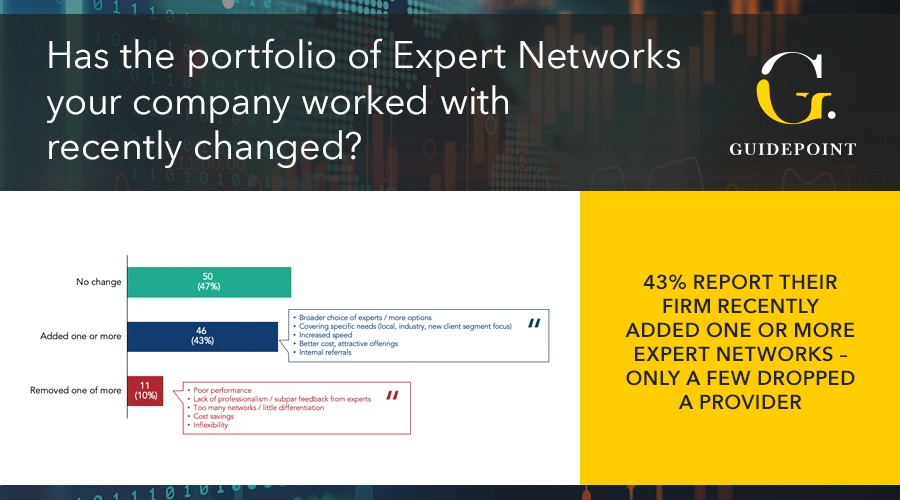

Perhaps the most problematic effect caused by organizational inefficiency is that Consulting Firms continue to sign on with more and more Expert Network providers. Our survey responses reveal the strategy of “adding more networks” vs. “active portfolio management,” with 43% of respondents indicating their firm has recently added more Expert Networks to their portfolio. In comparison, only 10% removed one or more providers.

The findings are especially concerning when we look into the spending for such engagements. Before, it was relatively common for Private Equity clients to support the cost for expert interactions on M&A-related Due Diligence. Nowadays, a considerable portion of the usage derives from non-M&A related topics, forcing Consulting firms to bear the cost themselves. That said, it is worth noting that this transition alone should lead to stakeholders taking a more active role in the selection and management of the ENS portfolio.

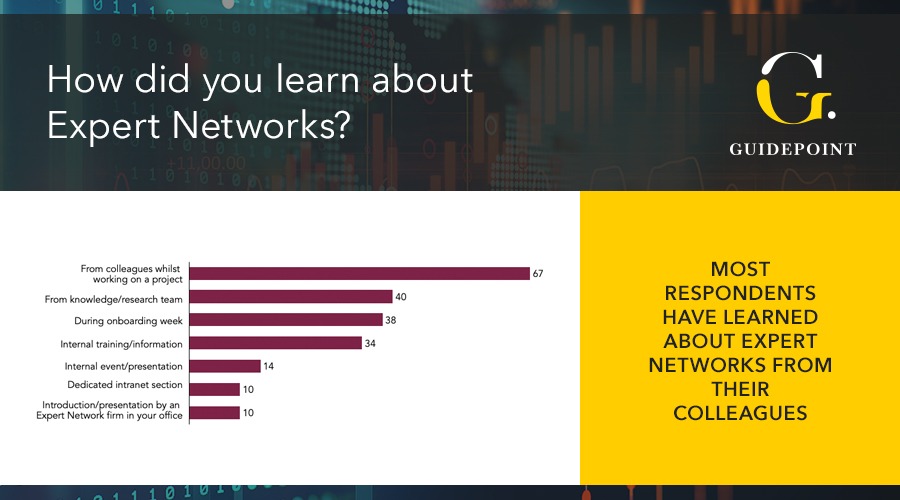

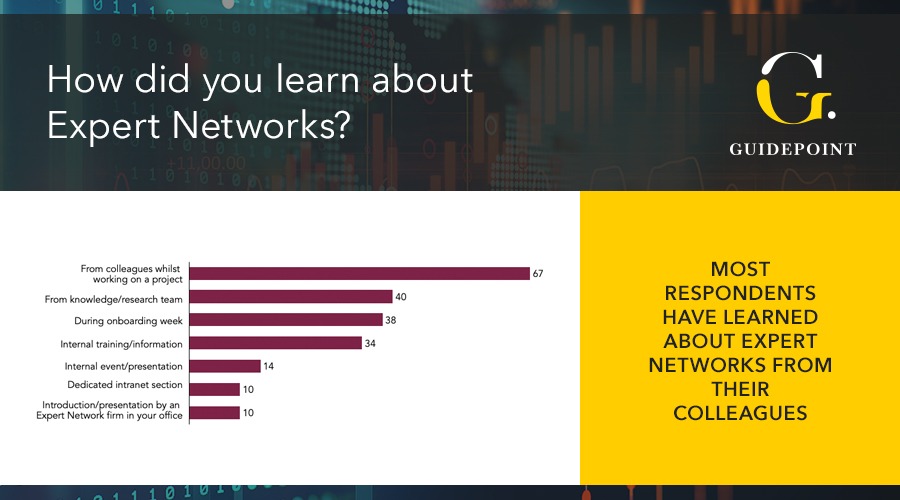

What’s more, 67 respondents stated they became familiar with Expert Networks through their colleagues while working on a project. Out of those surveyed, only ten respondents mentioned Knowledge and Research teams as a key-decision maker regarding which Expert Networks to contact on a project.

In fact, the Knowledge and Research teams’ rare involvement underlines Consultants’ preference to rely on their colleagues when deciding which Expert Networks to contact on a project. Interestingly, we have seen Consultants reaching out to as many as six networks (or more), when looking to conduct interviews with one or two experts.

Clearly, this practice is not efficient for any party involved. For instance, even working with more than three Expert Networks on the same project can become problematic. In this scenario, Consulting teams would have to alternate between different communication threads and formats (email, excel files, various platforms), coordinate with teams individually, and handle multiple work-streams at once.

It’s no wonder more experienced Consultants have begun to involve fewer networks. While there are no fixed guidelines for identifying the most suitable number of firms for a project, it is often more effective to work only with 2-3 trusted Expert Networks, resulting in reduced complexity and increased productivity.

In an ideal world, centralized Knowledge Management functions would have full transparency over the Expert Network portfolio performance and cost, enabling them to give highly-qualified recommendations to Consultants. However, a key question remains: How can these functions best evaluate the performance of Expert Networks?

Evaluating Your Expert Network Providers

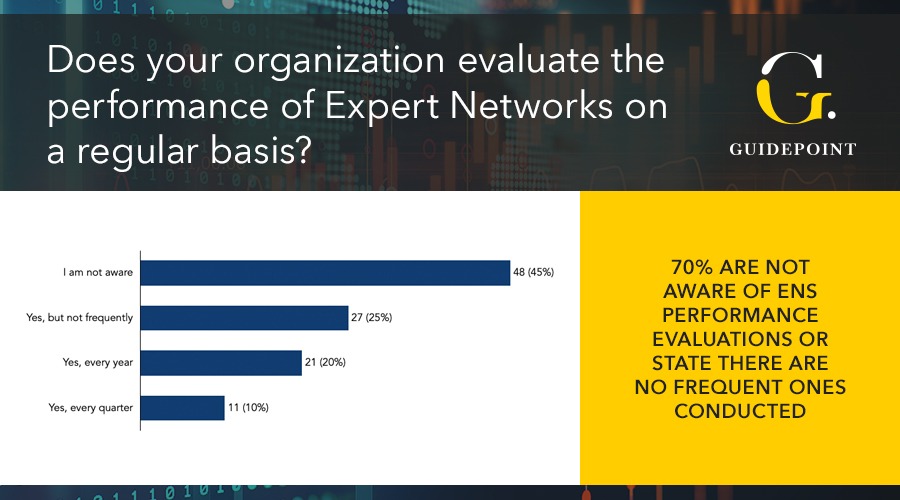

70% of respondents mentioned that they are not aware of Expert Networks’ performance evaluations or note that there are no frequent ones conducted in their organization. With little to no formal assessment of providers, it’s easy to see why choosing between multiple vendors hasn’t been the easiest task.

As described earlier, the lack of defined responsibilities makes the management of Expert Networks particularly difficult for Consulting Firms. The feedback gap seems to make matters worse, as there is little dialogue between actual users (Consultants), Knowledge/Research teams, and the Procurement teams.

To put it into perspective: Procurement teams are involved in the buying process. However, without frequent feedback on vendor performances from Consultants, they have no way to differentiate between Expert Network firms other than price. On the same note, Research/Knowledge teams are frequently responsible for raising internal awareness on Expert Networks, yet as we’ve seen before, they are often not involved in the actual decision-making process.

To tackle this ongoing challenge, Consulting Firms can implement a number of best practices. Suggestions include:

1. Automate the process of rating interviews/experts after each call. This practice will help Consultants decide the performance of individual expert networks, as well as which advisors to reconnect with on a follow-up call. Well-established Expert Networks should be able to provide aggregated long-term ratings of individual experts, thus assisting Consultants to make better selections throughout the process.

2. Conduct a monthly or a quarterly customer survey to collect feedback from all users on different Expert Networks. Note: While this can help obtain fast insights, it also has its limitations. Not all Consultants will be frequent users of such networks, hence lacking the experience to make an accurate assessment.

3. Implement a Net Promoter Score ranking after each project, as this will help assess Expert Networks’ performance. This is a crucial addition to rating individual experts, as it helps evaluate any provider’s service level. For example, on a 50-call campaign (part of a Due Diligence), a provider might identify 49 of the most knowledgeable advisors, while another network might come back with one good fit but obtain the same 5/5 rating in the process.

4. Schedule a monthly or quarterly feedback meeting with your Expert Network providers. This will be an excellent opportunity to review current usage, discuss spend, go through ratings, and survey results, as well as align on action plans to improve service (if/when applicable).

Besides evaluating quality, there are other aspects that Consulting Firms should factor into decision-making.

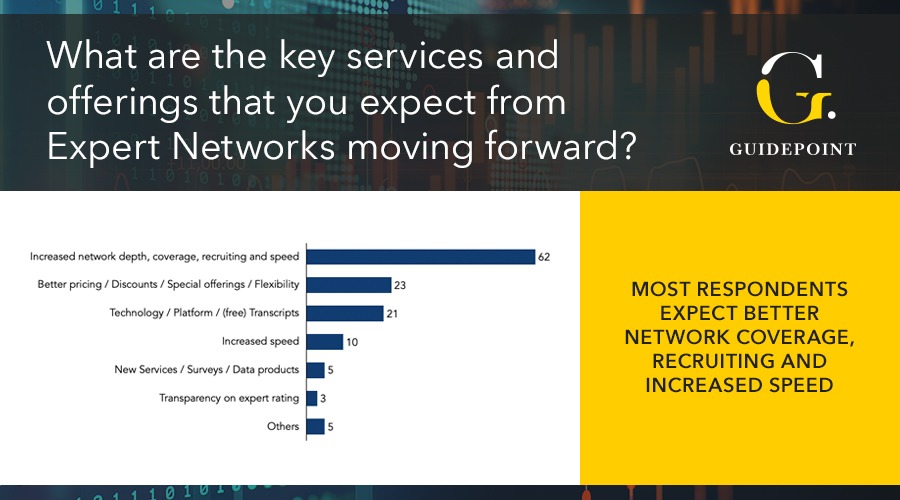

According to our respondents, some of the most significant points when working with Expert Networks relate to a lack of cost awareness and transparency. As anticipated, Expert Network users expect better pricing, discounts, special offerings, and flexibility moving forward (23).

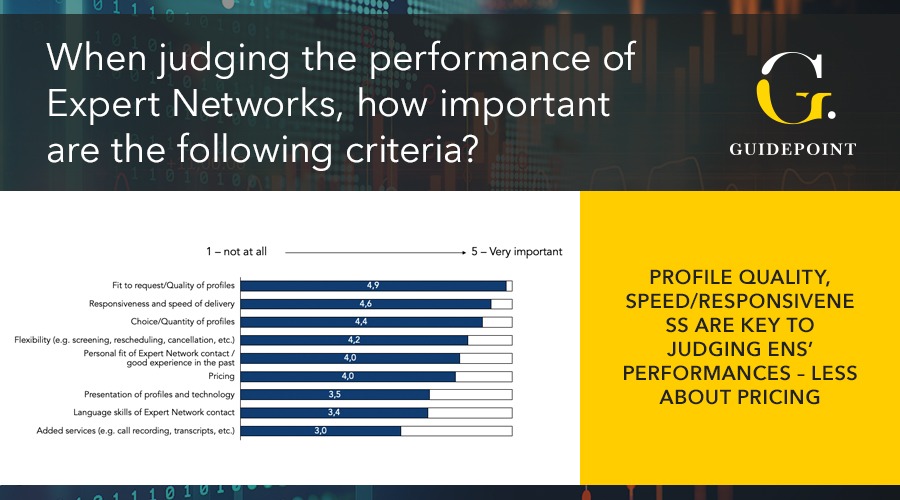

Moreover, as noted in our survey, a networks’ assessment seems to be positively correlated to the “personal fit” of an Expert Network contact (rated 4, from a scale of 1 to 5), thus emphasizing the importance of establishing a close relationship.

Our verdict: With an ever-increasing service usage and spend, Consulting Firms are perfectly positioned to consistently review their experience with Expert Networks, and based on the outcome, give precise indications on how vendors can improve their performance. By doing so, Consulting Firms can optimize service costs and reallocate the spending assigned to adding more networks.

*Note: In the next article, we will discuss in detail the criteria used to evaluate Expert Network services.

Enabling Consultants to Get the Most Out of Expert Networks

With relatively high employee turnover in Consulting, there will always be new users who have to familiarize themselves with Expert Networks. On the same note, many Consultants work in teams, resulting in a highly decentralized culture.

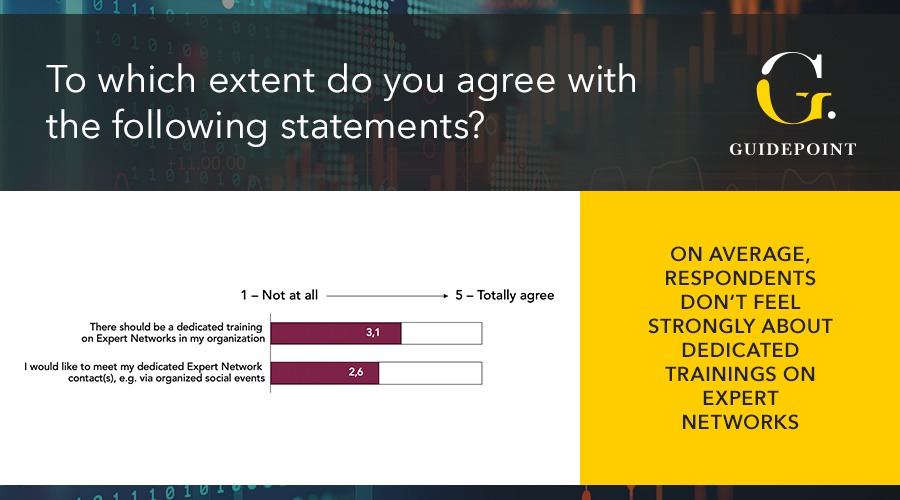

In the current setup, it’s not surprising that ”word-of-mouth” still plays a vital role. As mentioned earlier, more than half of respondents learn about Expert Networks from colleagues while working on live projects. What’s more, we’ve learned that internal training and events are rarely used as a source to understand more about Expert Networks and their service, as on average, respondents don’t feel very strongly about such practices (rated 2,6 from a scale of 1 to 5). Consequently, our respondents don’t see the need for dedicated training or in-person meetings with their Expert Network providers.

While dedicated intranet sections exist within their organizations, our survey has shown that respondents rarely access them to find out more about Expert Networks (10). Interestingly, 40 respondents mentioned Knowledge/Research teams as one of their primary sources for learning about vendors; somewhat surprising, considering these same teams reportedly have little influence on which Expert Networks get selected.

As the usage of Expert Network services across a variety of projects will most likely continue to increase, one cannot help but wonder why dedicated training on Expert Networks is not ‘’a must’’ yet. Besides addressing the information gap around Expert Network services, this activity could be integrated during onboarding. Furthermore, to increase awareness and see better project outcomes, Knowledge/Research teams should suggest vendors based on proactive portfolio management and continuous network evaluations.

To help Consultants make the most out of their interactions, Guidepoint has put together a guide on how to maximize efficiency when working with Expert Networks. Below are some of the practices which we recommend:

-

Consider the best format to help gain the expert insights needed (calls, surveys, workshops, remote assignments, etc.). It may include a combination of multiple formats or, on the contrary, one template only (depending on the user’s preferences)

-

Prepare an “Expert Tracker” document to be filled by networks involved to avoid wasting time on copy/pasting different formats.

-

Prepare interview guidelines (standard vs. expert-specific questions) to cover identified areas of interest (this will increase the efficiency during the call)

-

After initial interviews, there may be new angles determined or subject areas worth exploring further. Schedule follow-up calls to increase accuracy, deepen knowledge, and explore aspects that haven’t been previously considered

-

Always provide feedback on expert interactions after engaging with advisors

-

Carefully decide how many Expert Networks need to be involved in a project

KEY FINDINGS

While Consulting Firms recognize the importance of working with Expert Networks, most are not fully aware of how to actively manage their existing portfolio, adding more vendors in the process.

- 43% OF RESPONDENTS REVEAL THEIR FIRM HAS RECENTLY ADDED MORE EXPERT NETWORKS, WHILE ONLY 10% REMOVED ONE OR MORE

There is little to no formal assessment of providers, making evaluating and coordinating multiple vendors particularly challenging.

- 70% OF RESPONDENTS STATE THEY ARE NOT AWARE OF EXPERT NETWORK EVALUATIONS BEING CONDUCTED WITHIN THEIR ORGANIZATION (OR THERE ARE NO FREQUENT ASSESSMENTS)

A highly decentralized culture in Consulting is responsible for new users being unaware of Expert Network services and providers.

- MORE THAN HALF OF RESPONDENTS (62%) HAVE LEARNED ABOUT EXPERT NETWORKS FROM THEIR COLLEAGUES WHILE WORKING ON A PROJECT

Consulting Firms could benefit from improving efficiency with existing vendors to control spend as their usage increases.

- ACCORDING TO OUR SURVEY RESULTS, 80% OF RESPONDENTS EXPECT THE USAGE OF EXPERT NETWORKS TO INCREASE AT THE SAME PACE OR FASTER