by Ken Wahl, Data Insights, Guidepoint

Shire Plc’s (NYSE: SHPG) US hemophilia sales have faced much competition in recent years. In particular, their leading hemophilia A treatment Advate, an older, shorter-acting recombinant factor VIII, is facing many new US market entrants with longer half-lives. However, the global hemophilia portfolio including Adynovate has managed to maintain revenue stability. In a recent interview at the December 2017 American Society of Hematology meeting, Shire’s CEO communicated expectations of limited long-term impact. New product launches such as Bioverativ Inc.’s (NASD: BIVV) Eloctate, a long-acting recombinant factor VIII replacement therapy, or Roche Holding’s (SIX: ROG) Hemlibra, a groundbreaking therapy with a first-in-class mechanism of action (bispecific factor IXa- and factor X-directed antibody) approved for patients with hemophilia A with factor VIII inhibitors are leading challenges.

While Hemlibra’s FDA label is currently limited to patients with inhibitors, Roche is developing Hemlibra for the much larger non-inhibitor patient population, and with a potentially transformative improvement in dosing; subcutaneous prophylactic administration once every 4 weeks. Conventional wisdom suggests that any switching in prescribed treatment for a disorder such as hemophilia can be slow, but should Roche receive FDA approval for the non-inhibitor patient population, the market may be severely disrupted, and not just for Shire.

With so much at stake, and little real-time visibility into granular treatment trends and product usage, how can stakeholders truly monitor the hemophilia market?

The answer is the Guidepoint Hemophilia & Factor Replacement TRACKER.

The Guidepoint Hemophilia & Factor Replacement TRACKER reports monthly treatment data for the US hemophilia A, hemophilia B and von Willebrand disease markets in near real-time. Timely, quantitative and qualitative data, deep dives and drill downs uncover emerging trends and a unique perspective unavailable anywhere else. The Hemophilia & Factor Replacement TRACKER, with monthly patient case count data by use case beginning in May 2017, has already reported a number of emerging dynamics:

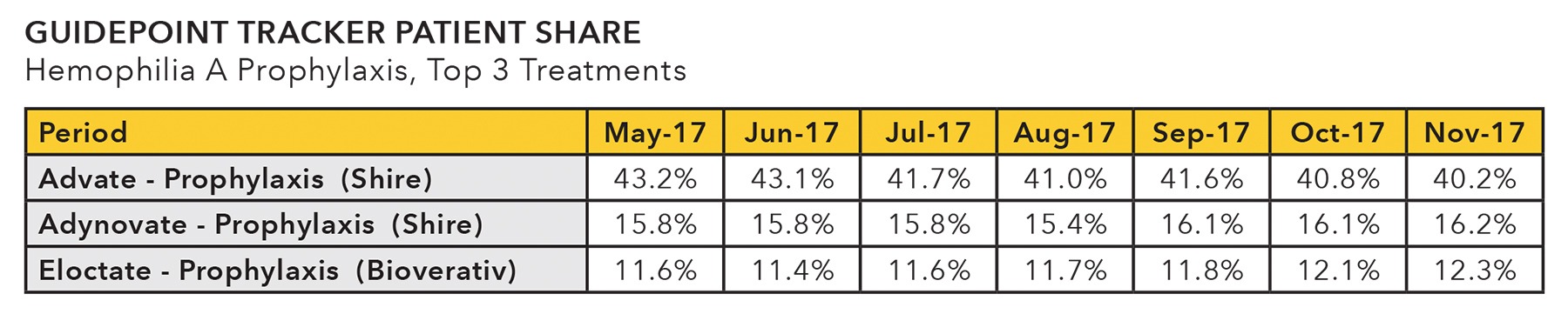

- Guidepoint Hemophilia & Factor Replacement TRACKER data indicates that share for leading hemophilia A prophylaxis therapeutic choices are changing. How will these trends continue to unfold with new market entrants, label expansions and mergers & acquisitions?

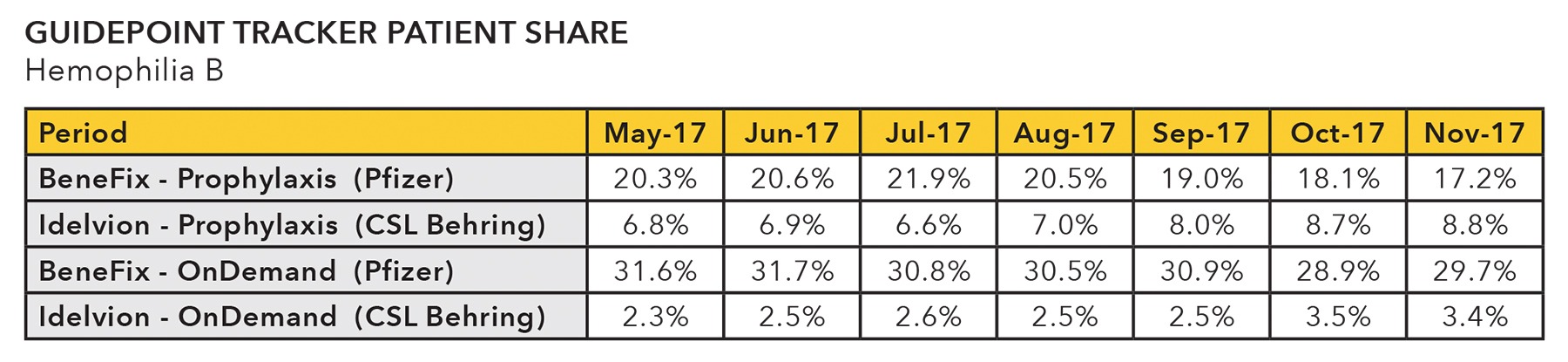

- Among hemophilia B treatments, CSL Behring’s (ASX: CSL) Idelvion has displayed a rapid uptick in both on-demand and prophylactic use. Will this be at the expense of Pfizer’s (NYSE: PFE) Benefix?

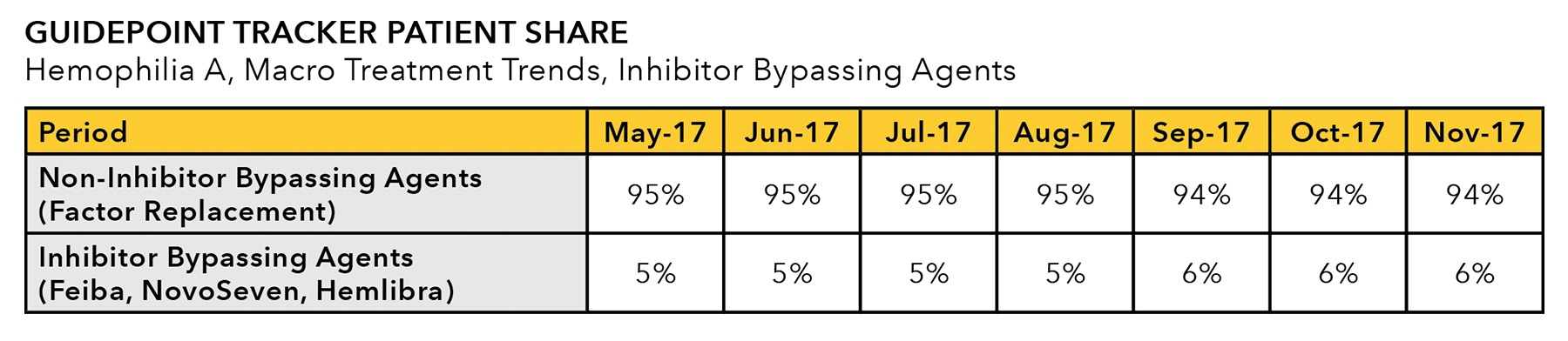

- In addition to brand-level use case data, Guidepoint TRACKER is well-positioned for macro disease treatment trend tracking, including long-acting vs. short-acting, prophylactic vs on-demand, and inhibitor bypassing agent use.

As a current or potential stakeholder in the hemophilia market, with so much on the horizon from “new and improved” to revolutionary, and even potential curative gene therapy in the future, how can you not need to know?

About Guidepoint TRACKER

Guidepoint TRACKER provides a unique multi-dimensional, quantitative and qualitative view of healthcare markets. By leveraging the power of Guidepoint TRACKER’s proprietary industry data, Guidepoint can provide a level of insight into market dynamics found nowhere else.