by Ken Wahl, VP Business Development, Data Insights, Guidepoint

Nevro Corp. (NYSE: NVRO) is a key player in the spinal cord stimulation (SCS) market. Since FDA approval of the Senza system in 2015, Nevro has taken ~15% market share from well-established market leaders Abbott/St. Jude, Medtronic and Boston Scientific. The U.S. SCS market was an estimated $1.7 billion in 2017 with a trailing 3-year CAGR of 15%. Growing acceptance of SCS as a therapeutic option, successfully executed clinical development and increased focus on non-opioid pain treatments have all been tailwinds driving Nevro’s success. However, recent FDA approvals have ushered in an entirely new lineup of competitive options for physicians and patients.

At the heart of Nevro’s success is their HF10 technology which delivers paresthesia-free therapy. However, since Nevro’s 2015 approval, Abbott/St. Jude, Medtronic and Boston Scientific have each rolled out their own competitive SCS devices:

- Nuvectra and Stimwave received FDA approval for their first generation SCS devices, Algovita and Freedom-8A, both in late 2015;

- Abbott/St. Jude received FDA approval in 2016 for BurstDR stimulation which mimics natural nerve impulse patterns;

- Medtronic received FDA approval in September 2017 for Intellis, delivering enhanced battery performance, improved high-dose/low-dose control and other features;

- Boston Scientific received FDA approval in January 2018 for its Spectra WaveWriter SCS System delivering both paresthesia and paresthesia-free therapy – a direct challenge to Nevro’s HF10 technology.

Clearly, the high growth SCS market continues to drive stakeholder interest and manufacturer innovation. But a key question remains unanswered: Can Nevro sustain their high sales growth moving forward or will reinvigorated competition potentially slow them down? With so much at stake and little visibility into implant usage and pricing, how can stakeholders truly monitor the U.S. spinal cord stimulation market?

The answer is Guidepoint’s Spinal Cord Stimulation (SCS) TRACKER.

Guidepoint’s SCS TRACKER reports monthly implant data for the U.S. SCS market in near real-time. Our monthly data can uncover emerging trends early on and provide a unique perspective unavailable anywhere else. Guidepoint’s SCS TRACKER aggregates data on new patient consultations, trial implant volumes, permanent implant volumes and implants by therapeutic region and has the ability to capture major shifts in implant usage ahead of earnings:

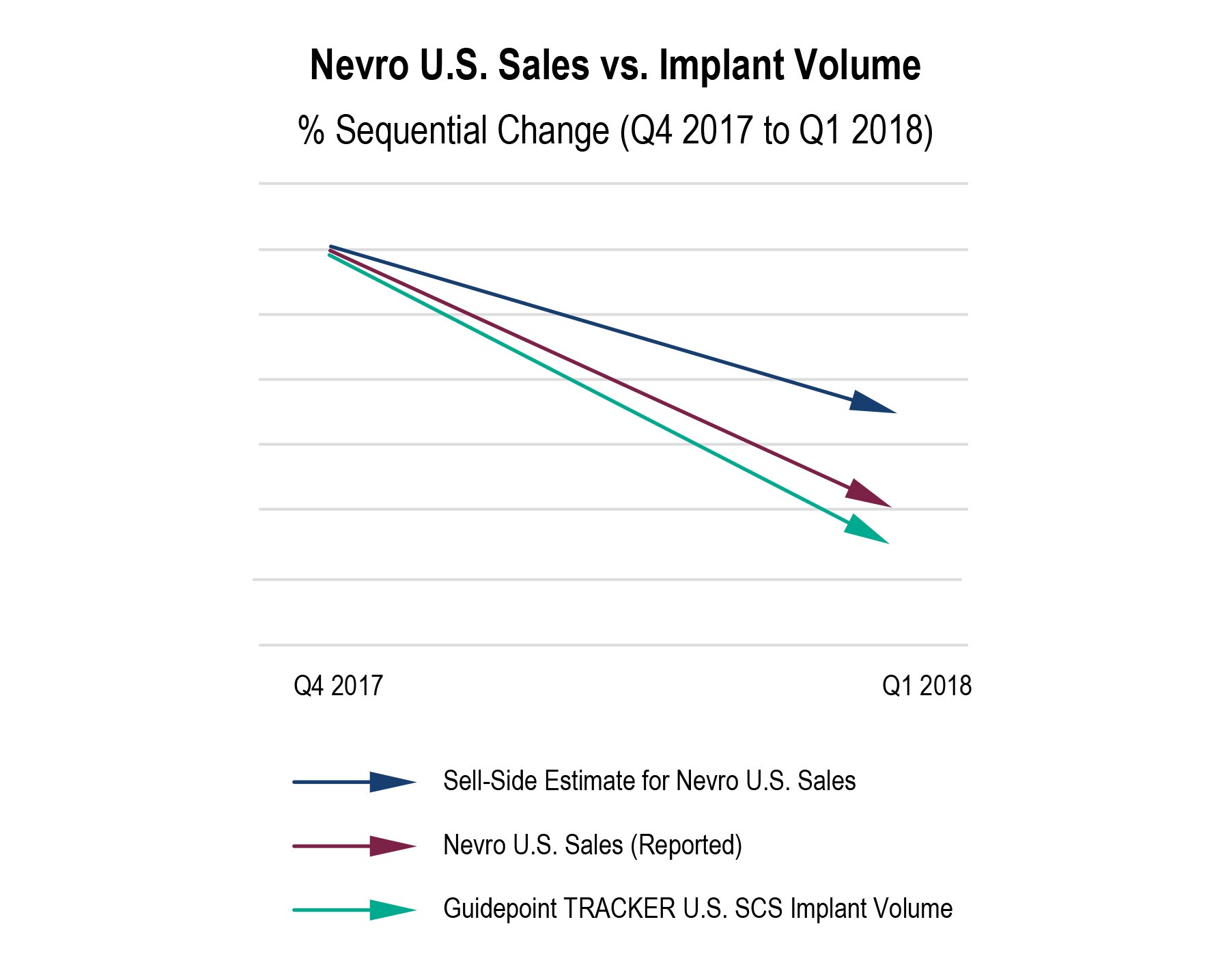

- Guidepoint SCS TRACKER data collected through May 4, 2018 showed a large sequential quarterly decline in Nevro’s Q1 2018 U.S. SCS implant volume compared to an increase in total U.S. SCS implant volume overall, thus indicating potential share loss from Nevro to competition. Three days later on May 7th, Nevro reported Q1 2018 U.S. revenue declining -13% sequentially vs. sell-side expectations of a -10% decline, which sent the stock price down -16% the next day.

As an existing or potential shareholder in Nevro, Boston Scientific, Medtronic, Abbott or Nuvectra, the Guidepoint SCS TRACKER can be a critical component of your research with timely market data on U.S. SCS implants and insight unavailable anywhere else.

Guidepoint is not a registered investment adviser and cannot transact business as an investment adviser or give investment advice. The information, analyses, forecasts, metrics, samples, estimated figures, trends, charts, tables, graphs, and projections contained herein or in any Guidepoint Data Product do not represent, contain or constitute investment advice and are not intended as an offer to sell or solicitation of an offer to buy any security, or as a recommendation to buy or sell any security and should not be relied upon as the basis for any transactions in securities.